Estrategia es decidir

qué se va a hacer

en los próximos 10 minutos.

En el mundo volatil y parcialmente impredecible de hoy, las compañías necesitan centrarse en sus capacidades, las de hoy y, fundamentalmente, las del mañana, que en última instancia son las vinculadas al lugar donde la organización quiere estar en el corto y medio plazo.

Responder de manera factual a preguntas simples como "¿Dónde estamos?" puede ser en ocasiones incierto e incómodo. Sin mencionar el "¿A dónde queremos ir?", o aún más complicado, "¿Cómo vamos a conseguir llegar hasta allí?"

Estos son los puntos de conexión con FdN, escuchar primero muy cuidadosamente y proporcionar después respuestas precisas, factuales, relevantes para el corto y medio plazo y decisiones complejas reducidas a simples elecciones que tomar.

Ya sea a través de una revisión de la Estrategia, de una Due Dilligence Commercial/Operativa, o apoyando en la Ejecución con los Presupuestos, su seguimiento y asesoramiento en el Board, desde FdN intentaremos aportar para que sean nuestros clientes los que decidan las respuestas adecuadas.

HOW WE HELP

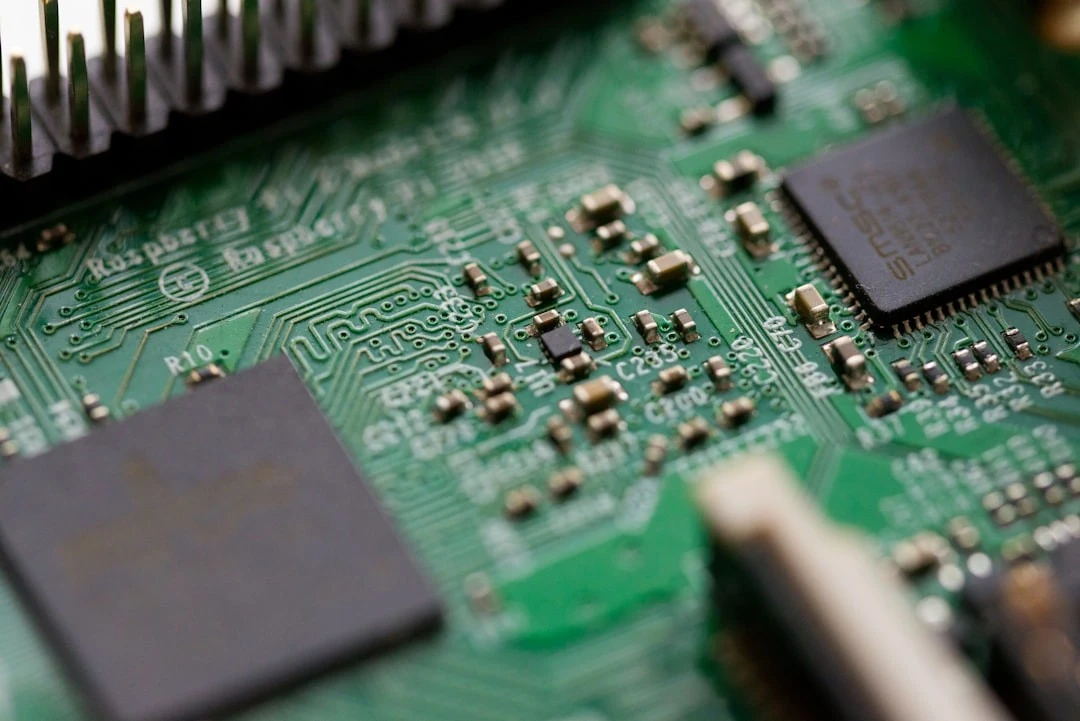

The Company in its Market Analysis (Corporate & Business Strategy Review) helps investors and corporate leaders understand how a business is positioned within its competitive landscape and what strategic paths can unlock sustainable growth.

We evaluate the company’s market share, customer segments, competitive differentiation, pricing models, and value proposition against industry dynamics and emerging trends. This structured analysis highlights both vulnerabilities and opportunities to strengthen the business’s strategic positioning.

For private equity portfolio companies and corporate subsidiaries in the mid-market industrial, technology, and services sectors, our review goes beyond theory: we stress-test business models, benchmark performance against peers, and identify actionable growth initiatives. The result is a clear, evidence-based roadmap that supports stronger strategic decisions, sharper execution, and long-term value creation.

#Strategy #Corporations #SMBs #DueDilligence #Commercial #Operations #Productivity #ProfitableGrowth

Business Plans & Budget (building support and methods) The best idea, no matter how strategic it is, means nothing if it is not tested, planned, and eventually approved for resource mobilisation, capital allocation and execution governance.

At FdN we are very conscious of it and we offer our help go put the numbers and financials to the associated Business Plan, advise on the steering for approval and translate it into revised Budgets and Objectives. Including modelling inorganic growth references, and organic transformations.

#BusinessPlan #Budgets #Acquisitions #Mergers #Transformation #Restructuring #Growth

Board Advisory & Follow up. Whether it is just an adjustment, an evolution or a full transformation, the FdN way pushes us to go beyond the Strategic Intend and its Business Plan, to follow up and show committment with the actual execution and realisation of the goals and benefits.

Strategy more a process than just an ideal destination, and daily business will bring new challenges and opportunities that shoulder to shoulder with the Company Board and its Executive team FdN will add its view to the achievement of the common success.

#BoardAdvisory #FollowUp #StrategyExecution #VUCA #Guide

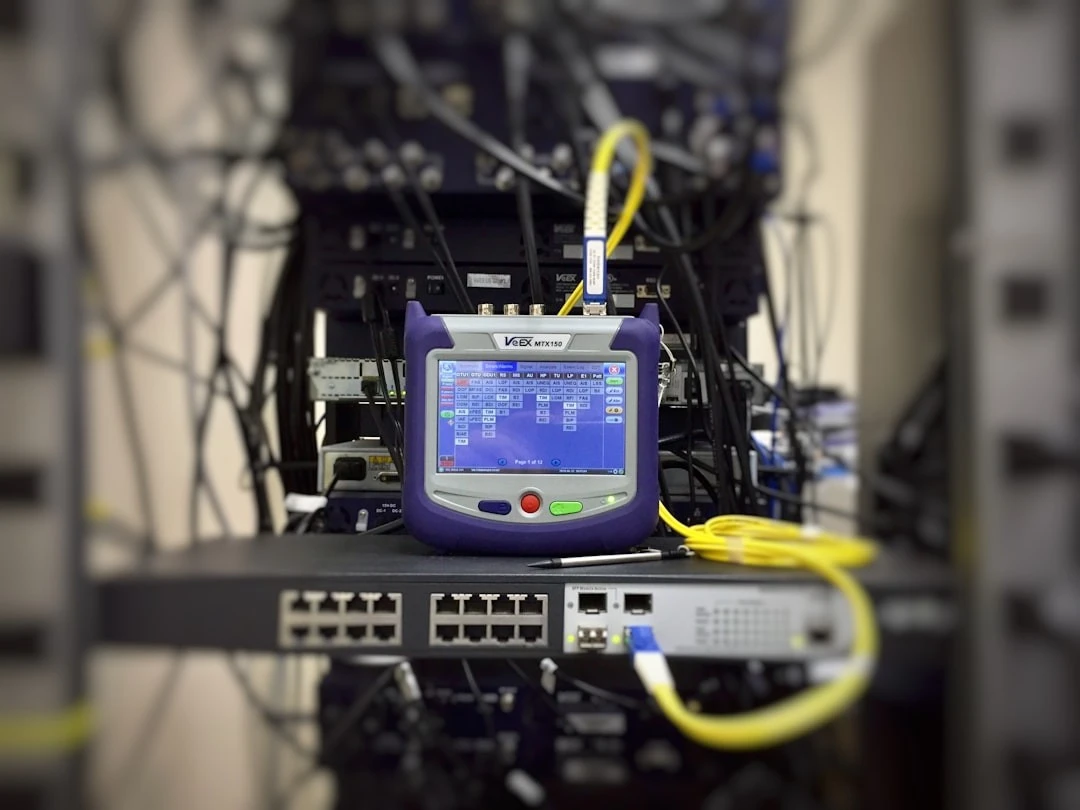

Commercial and Operational Due Diligence provides private equity investors and buy-side corporations and clients with a clear, independent view of a target company’s true potential before committing capital. We assess the attractiveness of its markets, the strength of its customer relationships and contracts, competitive positioning, pricing power, and growth opportunities, while also identifying potential risks.

On the operational side, we evaluate efficiency across processes, planning, forecasting and supply chain resilience, scalability, and technology readiness—highlighting both hidden costs and untapped levers of value creation.

Our approach is tailored to mid-market industrial, technology, medtech, and services companies, where market dynamics and operational execution are often decisive for returns.

By combining sector expertise with rigorous analysis, we deliver actionable insights that help investors validate assumptions, stress-test business plans, and make confident investment decisions.

Operational Sanity Checks (10-Day Pre-DD)

Before committing to a full due diligence process, it is often highly advisable to do a rapid, independent view of operational and commercial risk. The Operational Sanity Check provides exactly that: a focused 3 to 10-day assessment that identifies the real drivers of performance, operational bottlenecks, talent dependencies, customer concentration, and integration risks that can materially impact deal value. It is designed to give investor's leadership a clear first signal — “go”, “no go”, or “proceed with caution” — without the cost, disruption or time requirements of a full DD.

What executives receive

In 3 to 10 days (subject to company size and scope), the buyer gets a concise, decision-ready report covering: operational stability, scalability, maturity of processes, quality of earnings from commercial risk lens, preliminary synergy potential, red flags, and a recommended integration/post acquisition path. The result is a pragmatic, business-focused preview that helps executives avoid false positives, prioritize targets, and enter a full DD with sharper questions and stronger negotiating leverage.

#operationalsanitychecks #preDD #riskpreview #feudunord