We bring Investments

with committment,

purpose and alignment

Our Co-Investment opportunities emerge from the same loyal approach to industry knowledge as the rest of our services. Whether it is the need of an Operating Partner making sure that a Portfolio Company has all what it takes to deliver the expected results in the investment plan. Or the unique opportunity to make a Direct co-Investment in a specific club deal. Feu du Nord is the Investor's choice for a guarantee of independence, commitment, purpose and alignment with the expected results.

At FdN we spend hours of R&D to network, research and on-the-field profiling of, both, target companies and of all forms of Private Capital and Debt for the different company situations, maturities, alignment of goals, governance, track record, culture, etc. of each alternative.

We do also invest and co-invest directly ourselves in some of the opportunities.

HOW WE HELP

Existing Portfolio Companies should perform. But they do not always do it at the level required on the Investment Plan.

Changing all/part of management can be perceived as risky. Adding (and paying) more advisors could can sometimes be counter-productive, both in terms of governance risks and economic results.

Feu Du Nord offers to Private Equity firms and Family Offices their unique approach to Operating Partnerships. We invest the main part of our efforts in exhange of a piece of share in the realised value. And we do it with a full adaptation to the specific needs and resources of each portfolio-company momentum.

When / If needed our Operating Partnership approach can also bring co-investments into the table, whether on the form of equity, working capital financing, or private debt.

Get in touch with us, to share in full confidentiality (under NDA most of times) the situation of your investments in company that would require a "get-the-results" push, through management expertise and/or through capital co-investments.

#PortfolioCompanies #PrivateEquity #FamilyOffices #buyside #OperatingPartner #CSF #MultinationalVentures #JointVentures #Corporate-SponsoredFunds #NewVehicles #DealerQuality #SupplierQuality #TechnologyAccess #MarketExpansions

Out of our continuous and proactive activity in the screening and get-to-know-the-owner of companies in the mid-market, and/or in some special industry segments, we see unique investment oportunities to seize. After following a thorough qualification process, we bring those opportunities to a club deal of private investors that will decide with full liberty and without any pre-committed capital call, to go or not to go into the specific co-investment opportunity.

Our club deals are cost-efficient, most of time theme-driven, and can be subscribed on a quarterly basis. Small groups of co-investors are also welcomed to ask for a bespoke approach.

Feel free to get in touch with us and share your interests and/or requests of additional information.

#coinvest #clubdeal #pledgefund #keyindustries #uniqueinvestments

Engineering Firms, Big Operators, Foreign Investors, Public Administrations, etc can now be sure that this Special Public-Private Tender is well structured and governed, that this Project-Financing is having the right risk treatment to get the financing, that the company is talking the language of the banks and multi-lateral financing institutions. The success of the project, its feasibility and after more importantly its profitability and performance is depending on the right structured of its financing and drivers.

At FdN we can assist with a third-party independence, with a governace between technical and financial entities, or simply by teaming-up with the company CEO's and CFO's to be sure that the Project is done on-time and properly.

Structured-Finance is a sophisticated skill, so are we.

#PPPs #Public-PrivatePartnerships #SpecialTenders #StructuredFinancing #Non-RecourseFinancing #RisksAllocations #GovernancewithParties

ALTERNATIVES - A "MUST-HAVE" TO BE HANDLED WITH CARE

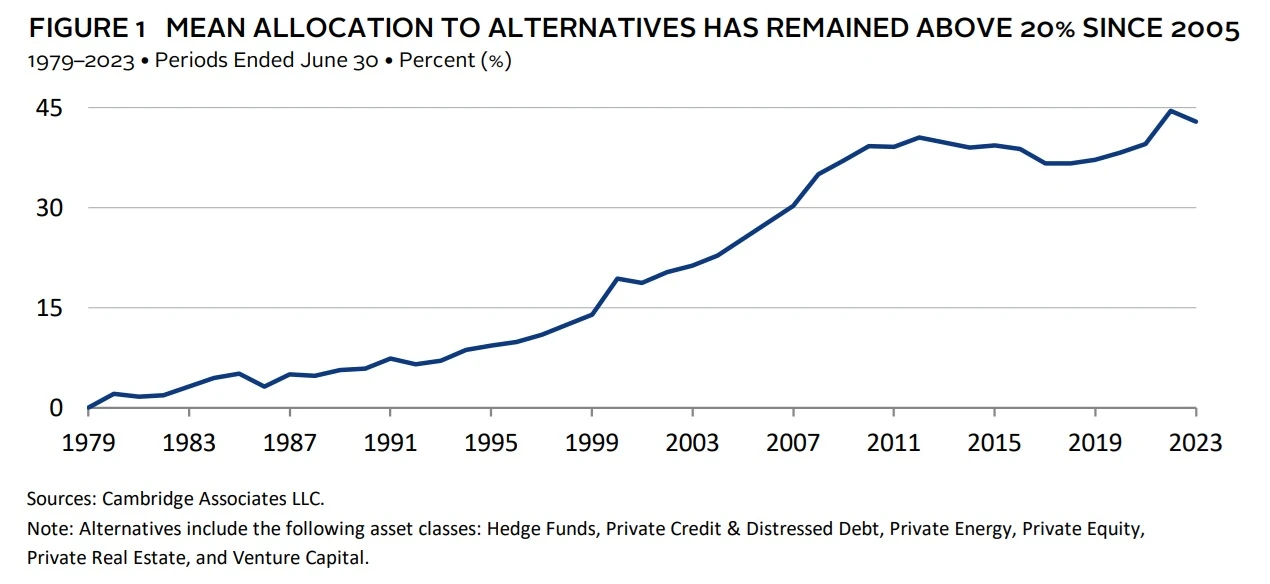

For Institutional Portfolios, mean allocation to alternative asset classes (including Hedge Funds, Private Credit, Private Equity, Private Real Estate, and Venture Capital) has remained above 20%, with Family Offices and Family Bankers staying normally above 10% at least.

These Alternative Assets are a "must-have" to achieve the expected two-digit returns, but doing the right asset selection is by itself a big source of extra returns (alfa), much more than in Bonds or Equity markets.