1. A Compass for Sales & Marketing Efforts

In the realm of corporate financial planning, the precise allocation of Marketing Costs and Sales Expense remains one of the most neglected yet vital management disciplines. Too often, businesses focus on whether they have the budget to spend, without ever rigorously questioning how much they should spend — and at what level such spending becomes profitable.

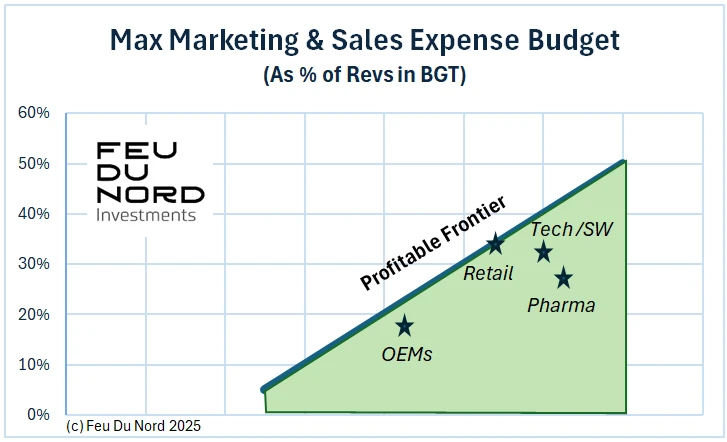

At Feu.Du.Nord, we believe that this is not simply a question of resource availability. It is fundamentally about understanding the profitable frontier of commercial investment — the point at which every incremental pound spent on sales or marketing continues to generate more than it consumes. This boundary is never fixed. It shifts according to industry context, product or service type, gross margins, go-to-market strategies, and, critically, marketing ROI.

The allocation of Marketing Costs and Sales Expense is too often a budgeting afterthought when it should be a strategic priority. Knowing what to spend is just as important as having the funds to spend it. Identifying the profitable frontier — and continuously managing towards it — is the difference between growth that is accidental and growth that is engineered.

2. The Misunderstood Expense: Marketing and Sales

In many organisations, Marketing and Sales expenses are treated as flexible lines on a spreadsheet rather than core levers of value creation. Worse, they are often among the first to be cut when pressures arise, without a proper evaluation of their contribution to growth, customer retention, or lifetime value.

However, high-performing businesses — and the investors behind them — understand that commercial costs are investments in future cash flow. When evaluated through the lens of return on invested capital (ROIC), internal rate of return (IRR), or time-weighted rate of return (TWRR), sales and marketing spend should be held to the same standards of accountability as capital expenditure.

3. Towards a Profitable Frontier

The optimal budgetary allocation of sales and marketing requires clarity on the following parameters:

-

Industry Benchmarks: High-growth sectors (e.g. SaaS or biotech) may require outsized early spend versus mature, margin-tight OEM industries.

-

Gross Margins: Higher margins afford more freedom to invest aggressively in customer acquisition or brand awareness.

-

Marketing-to-Sales Mix Strategy: Different industries have a different mix of Marketing-to-Sales Expense ratio. In Retail for instance we will find large %'s of marketing costs vs. Revenues, while at the same time a rather optimised sales-force. While in Software or Technology sectors we will find that sales force expenditure easily doubles all marketing efforts. Beyond a direct sales-led model has different cost dynamics from a channel or digital-first approach.

-

Minimum Viable Sales Productivity: Ensuring that every sales rep meets a baseline of sales minimum quotas in the right timing before scaling, is key to have a healthy expense allocation and commercial model.

-

Marketing ROI Tracking: Rigorous attribution models and performance metrics are non-negotiable for sustained profitability.

4. How we help

At Feu.Du.Nord, we work alongside Private Equity firms and Corporate leadership to define the right level of commercial expenditure — not only for short-term budget discipline but for long-term value creation. Our methodologies integrate market intelligence, financial modelling, and operational best practice to ensure budgets are not just “funded”, but justified and optimised.

Furthermore, we advocate for the must-do performance follow-up — without which no budgeting decision can be executed properly. By tying commercial inputs to measurable business outcomes, we bring transparency and precision to one of the most impactful areas of financial decision-making.