1. The Moment of AI

In 2018, I published one of my first articles, and perhaps one of the most widely read and impactful (Digital Transformation and Productivity: Running Away the Low-Cost Mantra). Seven years ago, digital transformation was not yet visible in the economy's aggregate productivity data, yet it was intuited, based on the correlation with the previous industrial revolution, that evidence of such improvement could not be far off on the near horizon. That same year, 2018, GPT-1 was launched.

Today, in 2025, we can say that the effects of digital transformation and AI are now beginning to be seen, tentatively, in labor productivity indicators in sectors such as the American financial and professional services sectors, for example.

Easy access to the first levels of AI, its spectacular and immediate applications, and above all, the intuition of an even more spectacular automation potential (limited only by the relative delay of electro-mechanical robotics when compared to the speed of AI development) have generated a boom in its use, its applications, and its future possibilities. Everyone is talking today about AI, and everyone, or almost everyone, claims to "know" about AI, but what are the risks and the key financial considerations when investing on it?

For entrepreneurs, managers, board members, and shareholders, the "ambient pressure," so to speak, is enormous. If any CEO were to publicly declare today that they won't invest in AI, he would probably be digging the grave of his/her professional career.

And yet, as an elementary school teacher used to remind us in class, "you have to keep a cool head and warm feet“.

Of course, "exploring" and "playing" with two pilot projects here and three "proofs of concept" projects there about AI is not only bad, but certainly interesting, both at the level of experience and politically, let's say. It happens, however, that quite a few companies have already moved beyond this stage of, more or less successful, experiments, and today technology providers and even shareholders or private investors are asking for "more AI“.

This article is aimed precisely at that situation, when focusing a “serious” investment decision in business AI.

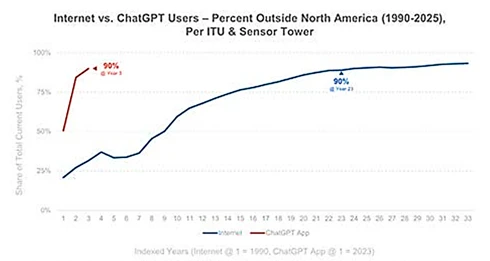

AI - GLOBAL ADOPTION PACE

Internet adoption reached 90% of users 23 year after creation (in blue)

ChatGPT reached 90% of users in just 3 years (in red)

Source: Bond – the AI Economy

2. A new Obsolescence

To illustrate the first concept, I'll use a real, personal analogy. I remember when I got married, back in 2002, we bought a fantastic CRT television, which required four well-muscled arms to move it. I still remember with some pain when, due to social pressure—let's say, "everyone" had a flat-panel TV—and the widespread use of digital platforms, we decided to upgrade to a magnificent 55-inch flat television with 4K OLED technology. That heavy CRT TV had cost us an arm and a leg, and fifteen years later, it was still delivering on its promise and working perfectly... but around it, the world of television content had changed..

Back to our case, let's now take into account that, since our beloved Professor Joseph Schumpeter linked technological innovation cycles with the economic cycles, we have seen these cycles gradually shorten, going from industrial revolutions lasting almost a century to technological “eras” lasting just over a decade.

In that period, just over a decade, SAP has released one version of HANA per year, with at least three updates in between every year. Microsoft has gone from releasing a version of Windows every two years to releasing some variant of it every six months, and some years even at a higher pace. Apple has changed its processor about 20 times, and ChatGPT has released one version per year since 2018. Without considering the evolution of the market capitalization of companies associated with this AI disruption, such as NVIDIA, for example.

Technological obsolescence in today's business is no longer necessarily a technical obsolescence, nor even a functional one; it is primarily an economic obsolescence and a matter of productivity relative to your competitors.

Hence the emergence and success, coupled with lower costs and increased communications capacity, of all types of services, technological infrastructure, applications, and even business processes in the cloud.

"I buy a service, and the provider will take care of renewing and updating it technically“, is the logical thought of every manager in this regard.

Except that this is noy always the case, and there are now quite a few cases of "obsolete clouds" that have been forced to accept technical disruption, and usually a significant price increase at the same time.

The cloud, whether public or even more so if private, assumes the risk of obsolescence like any other traditional technical architecture.

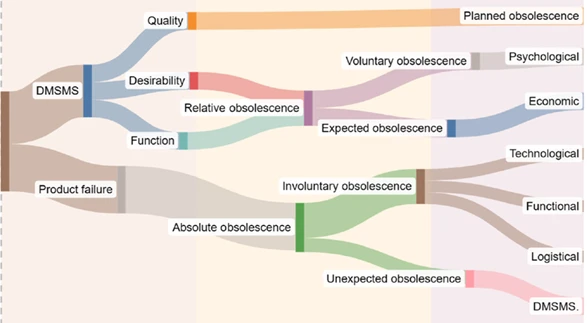

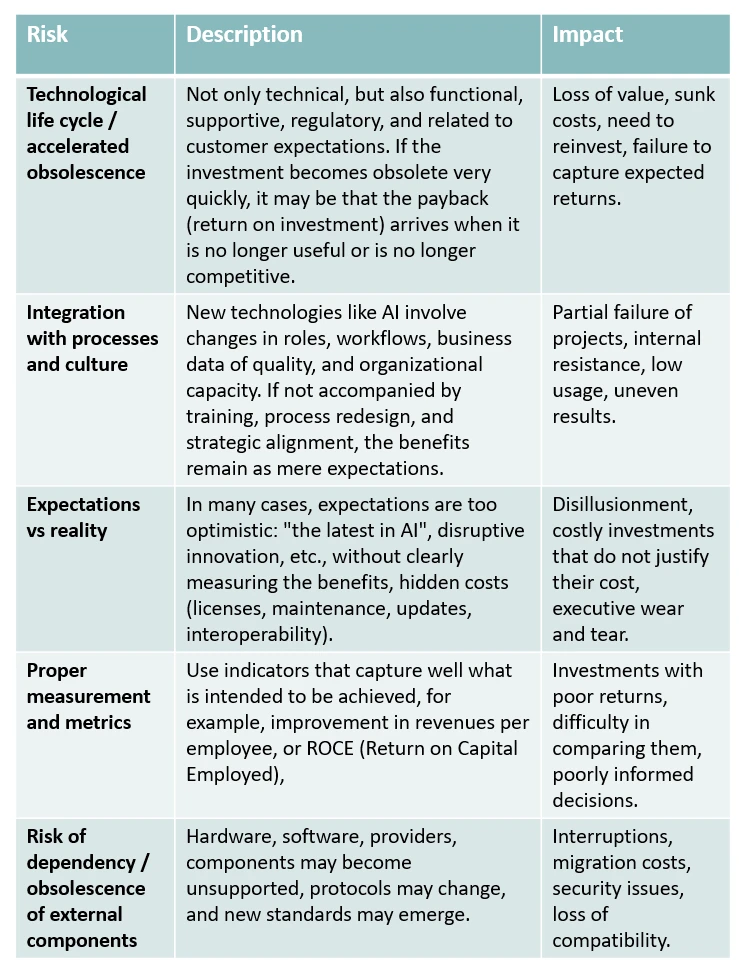

The first thing we need to do, therefore, when assessing an investment on AI and any other edge technology is the nature of its obsolescence risk, on its various forms; Technical, Functional, Planned or Scheduled, Economical and even Psychological and its possible social externalities.

OBSOLESCENCE, MORE THAN BEING OLD

Source: L. Sierra-Fontalvo et al.- DMSMS: Diminishing of manufacturing sources and material shortages

3. Breaking the Sound Barrier

As is well known, when an aircraft, often a fighter-bomber, flies faster than the sound of its engines, it breaks the sound barrier with a roar for any observer on the ground. The aircraft moves away faster than its own sound.

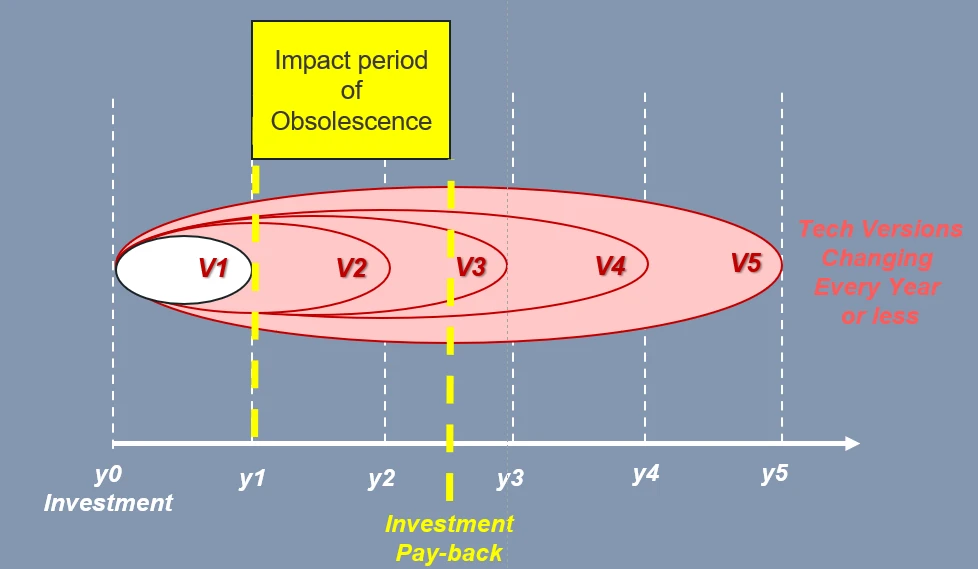

The rapid evolution and adoption of AI can, like the aircraft, break the barrier, not of sound, of course, but of the payback of the associated investment.

In other words, there is a high probability that we will invest in something, some application, integration, service, or automation with AI, whose "payback" will occur long after the technological development has become obsolete.

At the exponential rate of evolution of both technological architectures and AI software and algorithms, we will be buying something that, as in the television example, we will have to retire before its technical useful life has ended, and possibly even before we have recovered the investment.

AI INVESTING: BREAKING THE SOUND BARRIER

“Breaking the Sound Barrier”: AI-Tech changes faster than the Investment pay-back

Source: Feu Du Nord Investments

RISKS AND CRITICAL FACTORS IN AI AND EDGE TECH INVESTMENTS

Source: Feu Du Nord Investments

4. Your Productivity Frontier

Thoughtful readers will be rightly concerned at this point, as until now there seems to be no clear way out. Meanwhile, the astute reader will be starting to become wary of so much pessimism. The way out of this situation is to focus the investment objective on the possibilities of expanding the productivity of the company case, and not on the speed of change of on the AI context and all the technological possibilities at the edge.

The first reason has already been illustrated; by focusing our investment framework on the macro context and the latest technological edge, we will be entering into an equation where we will always lose, or it will never be advisable to invest, resulting in a stalemate that would ultimately take us out of the market.

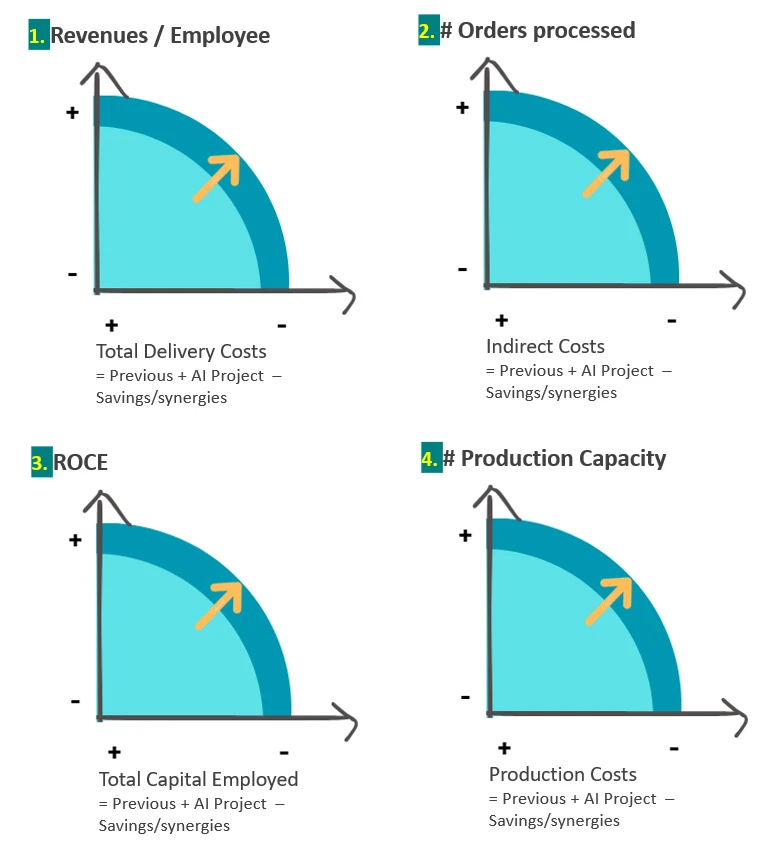

The second reason is often overlooked, what we want with our technological investment is not to "bring disruption or innovation to our company“, but rather to "expand our current capacity" and take it to a new frontier of productivity, which will ultimately also be subject to our sector and business model.

Consultants and even some executives often speak of wanting to bring "disruption" to the company. If disruption means “positive change”, then yes, but disruption has a certain connotation of disorder, of chaos, and chaos is never productive.

What we actually want to do, indeed, is to bring productivity to our company and expand the limits of our current capacity to a new frontier of productivity that will bring us more added value, better conditions for our teams, and consequently greater profits for our shareholders.

If we focus on understanding our current productivity and how we are going to improve it with the incorporation of AI and the associated technological innovations and automations, then we do have a clear framework of objectives and investment to work on and measure the results objectively.

Exponential change is one of the things that human beings find it difficult to perceive intuitively, and we are facing one, which, as the cycles of innovation shorten, we will have to learn to ride waves that are increasingly higher, but shorter.

PRODUCTIVITY FRONTIERS - ALTERNATIVE VIEWS

5. How we help

MARKET STRATEGIES

Understanding markets and value creation dynamics is the essence of what we do. We only advise in verticals that we master and we start always by listening carefully to our clients. Our strategy thinking is always precise and fact based, sitting right in the center of the Board Agenda. We help with:

-

Strategy checks

-

Board memberships

-

Strategy Definition

FINANCIAL ADVISORY

Our Financial Advisory do not compare nor substitute accounting or transaction services. We will focus on the strategy of a transaction, the business plan, the scenarios and the valuation of it. We play the role of marking well the yellow road with side red lines for any transaction, making sure of governance and focus if required.

-

M&A approach, strat & valuation

-

Negotiation guide

-

Transaction governance

INDUSTRIAL PARTNERSHIPS

Despite difficulties, or precisely because of them, we know how to help on the choice and formation of Strategic Alliances and Joint Ventures, typically for achieving Capital Solutions, Market Reach, or Winning Tenders.

-

Strat Alliances guide

-

Tenders in co-operation

-

Public-Private Partnerships

CO-INVESTMENTS

Whether it is the need of an Operating Partner, Or the unique opportunity to make a Direct co-Investment in a specific club deal. Feu du Nord is the Investor's choice for a guarantee of independence, commitment, purpose and alignment with the expected results.

-

Operating Partnerships

-

Direct Co-Investments (Club Deals)

-

Joint-Ventures